Scrapping VAT on household energy: what it could mean for your bill

There’s talks in Westminster that the Chancellor is exploring a temporary reduction of VAT on domestic gas and electricity from 5% to 0%, with the idea appearing in pre-Budget briefings as a quick way to give households some headroom on costs.

This would show up directly on bills as a small but immediate saving, and it would sit on top of whatever Ofgem sets each quarter through the energy price cap.

An overview to the proposal

What’s being considered?

A cut in VAT on household energy to 0%. HM Treasury would need to legislate, and suppliers would pass the change through to customers’ bills.

How big is the saving?

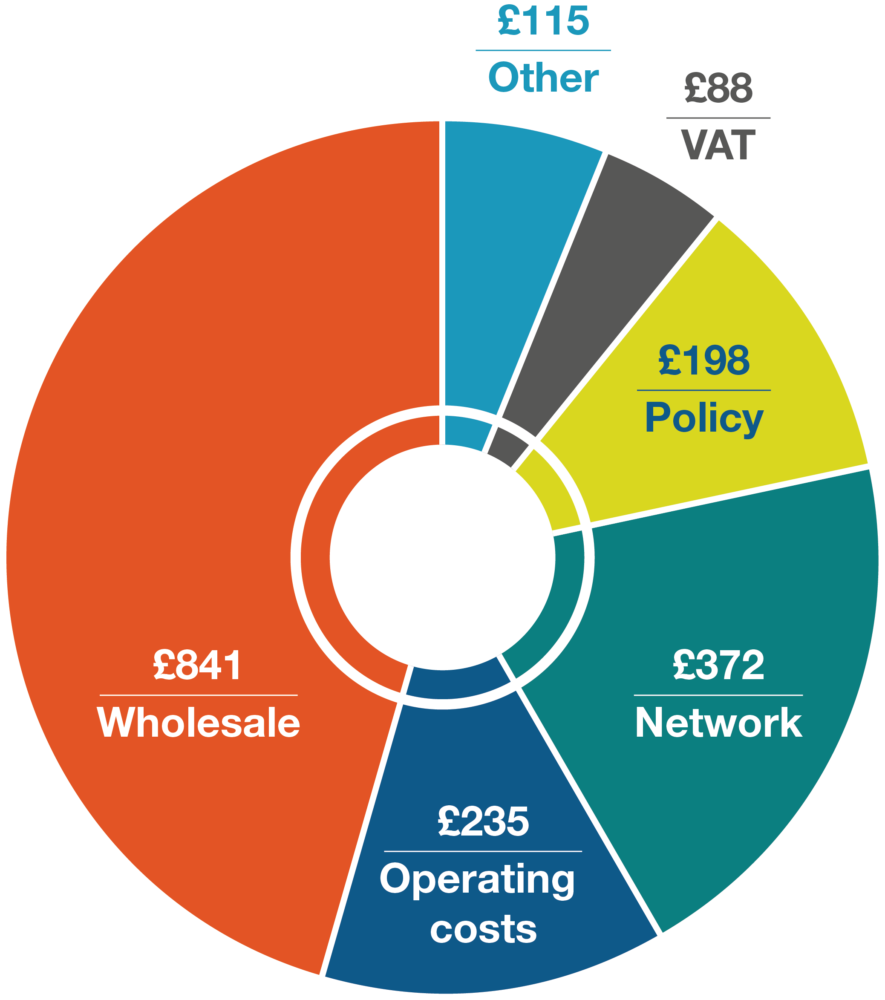

Roughly £88 a year for a “typical” user at today’s cap, using Ofgem’s typical domestic consumption values as the yardstick; your actual saving scales with your own usage profile and tariff.

Who’s covered?

Households only. Business bills aren’t affected by a domestic VAT change, so companies should continue to focus on procurement strategy and usage reduction.

What else is on the table?

Ministers are also said to be looking at shifting some policy/green costs off bills, which could be worth around £200+ a year for an average household, but this would require decisions across HM Treasury and the Department for Energy Security & Net Zero (DESNZ) and may come with fiscal trade-offs flagged by the Office for Budget Responsibility (OBR).

Energy price cap — Typical household energy bill

Purely Energy view

Source: Ofgem • Chart rebuilt by Purely Energy (illustrative, based on public figures).

Why this matters now

Bills are lower than the 2023 peak but, as Ofgem’s cap updates keep reminding us, they’re still materially higher than pre-crisis levels, and arrears remain elevated according to charities such as Citizens Advice and think tanks like the Resolution Foundation.

A VAT cut is one of the fastest levers the Government can pull because it requires minimal system change from suppliers and creates a visible reduction that consumers can understand without decoding complex tariff mechanics, in short a 5% discount from what they were paying prior.

On the below image , the £88 VAT , would be cleared completely from invoices, it is also worth noting the £198 worth of policky per annum set by the government which could also be cut heavily to reduce bills.

Graph from Energy UK

How your savings would really work

Ofgem’s cap is built using its Typical Domestic Consumption Values (TDCVs) to illustrate what a “typical” household might pay, but no one is truly “typical.” If you use less than the TDCV, your saving would be less than £86; if you use more, it would be more.

Importantly, unless the Government also reforms standing charges, which Ofgem regulates and which network operators and policy costs feed into.

You should expect the VAT change to apply only to the unit-rate and standing-charge VAT elements as they exist today, rather than a wholesale redesign of what you’re charged.

What wouldn’t change (at least for now)

Even if VAT is cut to zero, the price cap will still move quarterly as Ofgem reflects wholesale markets, policy costs and network charges.

The energy market design, overseen by Ofgem and, where relevant, the Competition & Markets Authority (CMA). Would carry on as is, so any relief from VAT would sit alongside whatever the next cap calculation brings.

Business tariffs would be unchanged by a domestic VAT change, and any reform of standing charges or socialised policy costs would require a broader decision across DESNZ, Ofgem and network companies, plus a funding route endorsed by HM Treasury and scrutinised by the OBR.

Pros

and

cons

Pros: quick to deliver, easy to understand, and it helps every home immediately without complex eligibility tests.

Cons: costly for the public finances, not targeted at those in the deepest difficulty, and it doesn’t fix structural drivers like network costs, volatility in wholesale gas, or how standing charges impact low-usage, lower-income households.

What to do next

Households: keep readings up to date, use your supplier’s usage tools, and attack easy wins - heating schedules, insulation, LEDs, and appliance run-times.

Businesses: a domestic VAT cut won’t touch your bills unless you are providing energy for domestic end users, Business would be - Charities, Care Homes, Schools and Hospitals where they are currently paying 5% on VAT, rather than the 20%.

Work with Purely Energy

If you want a clear, numbers-first plan. Whether you’re a multi-site group or an SME, we’ll map your contracts, consumption and standing charges against Ofgem’s latest methodology and design a route to lower costs and lower risk - along with Why you should pick Purely Energy

Get in touch below and we’ll start with a short no jargon plan of action to save you the most amount of money across your multi site bills