UK Energy Supplier Closures

| Date | Supplier | Customers | Acquiring supplier |

|---|

The Direct Link Between Wholesale Gas Prices and Market Collapse

Report Date: November 10, 2025

Analysis Period: July 2018 - November 2025

Total Suppliers Failed: 54

Total Customers Affected: 6,012,316

EXECUTIVE SUMMARY

Between 2018 and 2025, the UK energy market experienced an crisis that resulted in 54 energy suppliers ceasing operations, affecting over 6 million customers. The crisis was directly caused by a dramatic surge in wholesale gas prices that began in August 2021 and peaked in August 2022, with prices reaching £250/MWh - over 10 times higher than pre-crisis levels.

Key Findings:

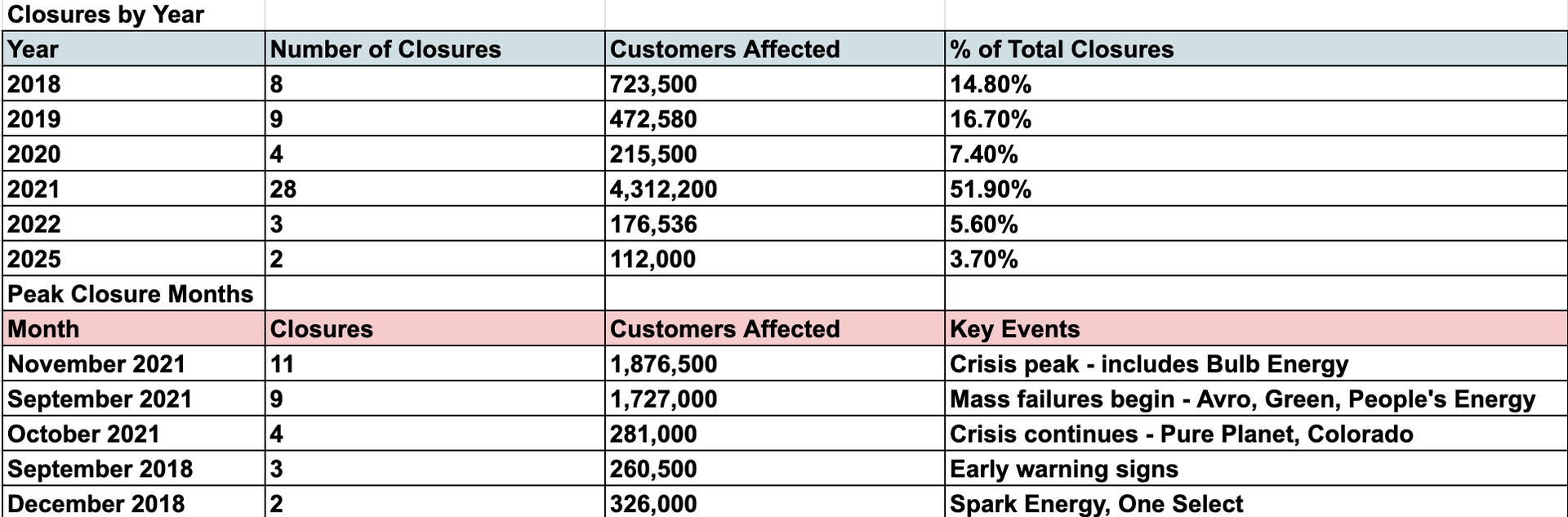

- 2021 was the crisis year: 28 suppliers (51.9% of all failures) collapsed in a single year

- November 2021 was the peak month: 11 suppliers failed affecting 1.88 million customers

- Bulb Energy was the largest casualty with 1.7 million customers

- Octopus Energy became the biggest beneficiary, acquiring 2.37 million customers

- 71.7% of all affected customers were impacted during 2021 alone

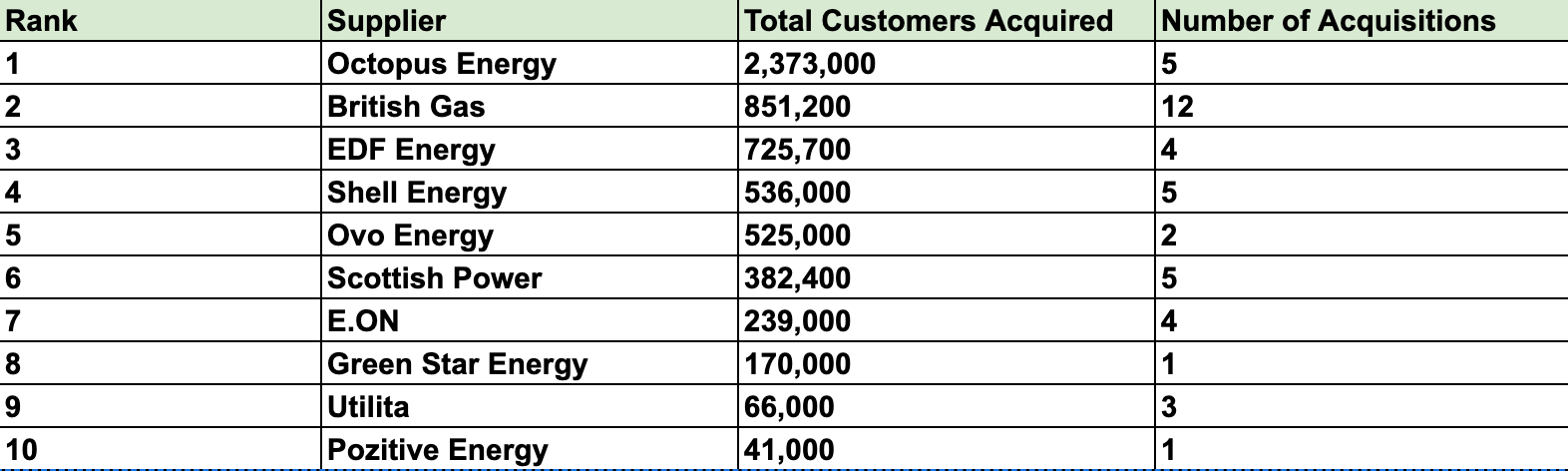

1. TOP ACQUIRING SUPPLIERS: WHO BENEFITED?

When energy suppliers fail, Ofgem's "Supplier of Last Resort" process transfers customers to surviving companies. The table below shows which companies took on the most customers:

Top 10 Acquiring Suppliers (2018-2025)

2. TIMELINE ANALYSIS: WHEN DID SUPPLIERS FAIL?

Closures by Year & Peak Closure Months

3. THE WHOLESALE GAS PRICE CONNECTION

The Crisis Timeline: How Gas Prices Triggered Market Collapse

Phase 1: Pre-Crisis Stability (2018-2020)

- Wholesale Gas Price Range: 1.5-2.5 p/KWh

- Market Conditions: Stable, competitive market with ~70 suppliers

- Closures: Sporadic failures (21 suppliers over 3 years)

- Root Causes of Early Failures:Poor business models

- Inadequate hedging strategies

- Weak financial management

- Normal market competition

Phase 2: Crisis Ignition (August 2021)

- Wholesale Gas Price: Spiked 70% in August alone, reaching 6 p/KWh

- Trigger Events:Cold winter 2020/21 depleted gas storage

- High Asian LNG demand drove up global prices

- Reduced Russian gas supplies to Europe

- Post-COVID economic recovery increased energy demand

- Low wind generation reduced renewable supply

August 2021 marked the beginning of the crisis. Within weeks, suppliers began failing as they faced:

- Fixed-rate contracts that couldn't cover wholesale costs

- Ofgem's price cap preventing cost pass-through to customers

- Insufficient hedging leaving them exposed to spot market prices

Phase 3: Crisis Peak (September-November 2021)

- Wholesale Gas Price: Rose from 7.0 p/KWh to 9.5 p/KWh

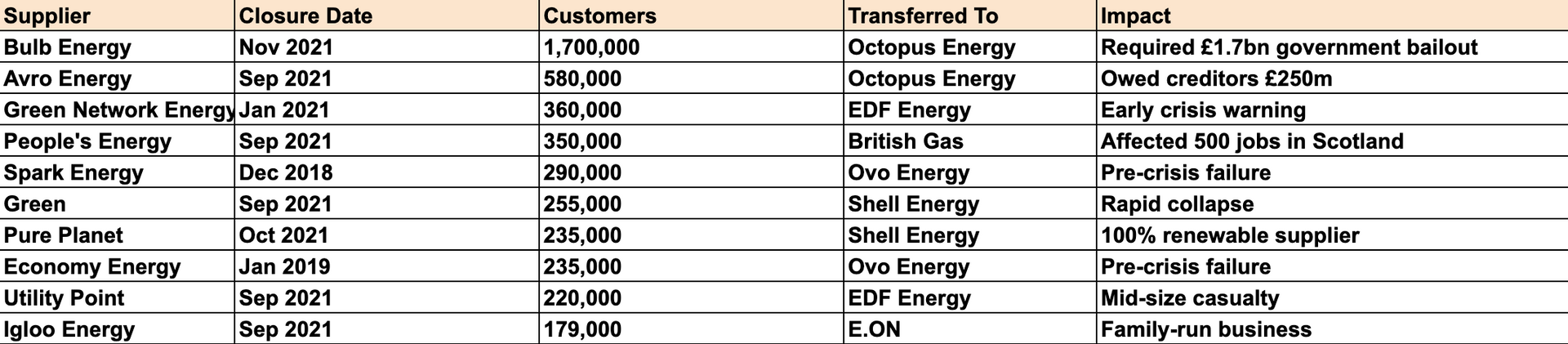

- September 2021: 9 suppliers failed including Avro Energy (580,000 customers)

- October 2021: Prices hit 8.5 p/KWh, 4 more failures

- November 2021: 11 suppliers collapsed including Bulb Energy (1.7M customers)

Key Statistic: Gas prices increased by 250% between January and September 2021, with wholesale costs far exceeding the Ofgem price cap.

Phase 4: Peak Wholesale Prices (2022)

- Wholesale Gas Price: Reached 25.0 p/KWh in August 2022

- Context: Russia-Ukraine war disrupted gas supplies

- Impact: By this point, most vulnerable suppliers had already failed

- Survivor Strategy: Remaining suppliers were well-capitalised with strong hedging

Phase 5: Price Stabilisation (2023-2025)

- Current Gas Prices (2025): 5.0-6.5 p/KWh (still 3x pre-crisis levels)

- Market Consolidation: Only ~25 suppliers remain (down from 70)

- Recent Failures: Rebel Energy and Tomato Energy in 2025 show ongoing pressures

Phase 6: Price Stabilisation (2025-2027)

- Current Gas Prices (2025): 2.0-3.5 p/KWh (still 2x pre-crisis levels)

- Market Conditions: The forward curves are lower which means on longer term contracts the prices are cheaper

- Context: There are more LNG projects worldwide which is reducing the cost of gas in all nations

Why Did the Price Cap Cause So Many Failures?

The Ofgem price cap, designed to protect consumers, became a death sentence for poorly-managed suppliers:

- The Squeeze: Suppliers bought gas at wholesale prices (7.0-25.0 p/KWh) but could only charge customers the capped rate

- Failed Hedging: Many small suppliers didn't buy energy in advance to lock in prices

- Credit Balance Dependency: Some suppliers (like Avro) relied on customer credit balances to fund operations

- Fixed-Rate Tariffs: Suppliers were locked into year-long fixed contracts at pre-crisis prices

Result: Companies selling energy at a loss, burning through cash reserves, and ultimately collapsing.

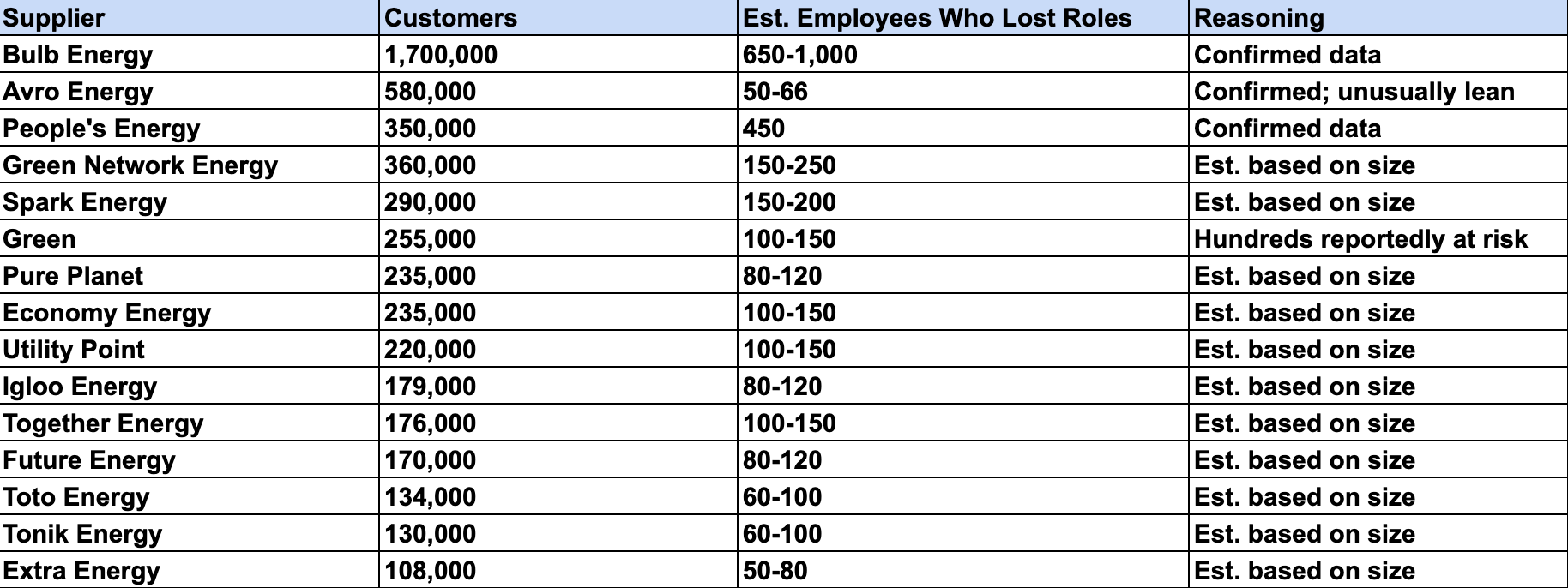

4. THE HUMAN COST

Customer Impact

- 6,012,316 customers were forcibly switched to new suppliers

- £2.6 billion cost to consumers (excluding £1.7bn taxpayer bailout for Bulb)

- £94 average cost per household to cover failed supplier costs

- 10 million households estimated to be in fuel poverty by mid-2025

Market Transformation

Before Crisis (2021):

- 70 energy suppliers operating

- Competitive market with low-cost deals

- Many "challenger" brands offering 100% renewable energy

After Crisis (2025):

- 25 suppliers remaining

- Market dominated by large, established firms

- Reduced competition and choice for consumers

- Higher barriers to entry for new suppliers

5. LARGEST INDIVIDUAL FAILURES

The "Big Ten" Casualties

6. ROOT CAUSES: WHY DID SO MANY FAIL?

1. Inadequate Hedging

Many small suppliers failed to buy energy in advance, leaving them exposed to spot market volatility. When prices spiked, they had to buy at peak prices while charging customers capped rates.

2. The Price Cap Paradox

Ofgem's price cap protected consumers but prevented suppliers from passing on wholesale costs. The cap increased by only 12% in October 2021, but wholesale prices had risen 250%.

3. Weak Capitalisation

Many "challenger" suppliers entered the market with minimal capital reserves. When losses mounted, they had no buffer to survive.

4. Fixed-Rate Tariff Risk

Suppliers offering fixed-rate contracts for 12-24 months were locked into loss-making agreements when wholesale prices soared.

5. Regulatory Failure

Citizens Advice found that Ofgem "missed multiple opportunities to regulate the market" and that enforcement staff actually decreased 25% between 2017-2021 despite growing concerns.

7. CURRENT STATUS (NOVEMBER 2025)

Market Today

- 25 active suppliers (down from 70 in 2021)

- Consolidated market dominated by large firms

- Gas prices still 2x pre-crisis levels at 2.5-4.0 p/KWh

- Recent failures (Tomato Energy, Rebel Energy) show ongoing pressures

Price Outlook

- October 2025 price cap: £1,754/year (up 2% from July)

- Expected Q1 2026: ~£1,720 (slight decrease)

- Long-term trend: Prices likely to remain elevated due to:

- UK's continued gas dependency

- Global market volatility

- Infrastructure investment costs

- Policy costs (net-zero transition)

Energy Security

The crisis has accelerated the UK's push for:

- Renewable energy expansion to reduce gas dependency

- Nuclear power investment for baseload capacity

- Energy storage (batteries) to balance intermittent renewables

- Demand-side response technologies

- Home insulation programs to reduce consumption

CONCLUSION

The 2021-2022 UK energy supplier crisis was the direct result of a perfect storm: surging global gas prices, inadequate supplier hedging, weak regulation, and a price cap that prevented cost recovery. The crisis fundamentally reshaped the UK energy market, consolidating power among larger, better-capitalized firms while costing consumers billions.

The core lesson: The UK's heavy reliance on gas for electricity generation creates vulnerability to global price shocks. Until the country transitions to a more diverse, domestically-sourced energy mix, similar crises remain possible.

Looking ahead: While the acute crisis has passed, wholesale gas prices remain elevated, and the market remains fragile. The transition to renewable energy is now seen not just as an environmental imperative but as essential for energy security and price stability.