The Rise and Fall of Tomato Energy: A Cautionary Tale for Business Customers and Brokers

On November 5th, 2025, Tomato Energy ceased trading, leaving 23,000 customers scrambling. While Ofgem's safety net ensured continuity of supply, this collapse reveals a crucial lesson: the cheapest rate isn't always the best value.

The Fatal Flaw: Zero Standing Charges

Tomato Energy, founded in 2015 and rebranded twice before settling on its final name in 2022, positioned itself as a sustainable energy supplier. Their unique selling point?

Zero standing charge contracts. No daily fees - just pay for what you use. It sounded perfect.

But here's what they didn't advertise: When you supply energy to business customers, suppliers must pay Distribution Use of System (DUoS) charges and Transmission Network Use of System (TNUoS) charges. These aren't optional - they can exceed £100 per day (over £36,500 annually) regardless of consumption.

By offering zero standing charges, Tomato absorbed these massive costs while charging customers nothing. Internal correspondence from August 2024 reveals the company's trading team admitting contracts were "at a loss to us" because consumption wasn't high enough to cover the standing charge cost to the transmission and distribution costs.

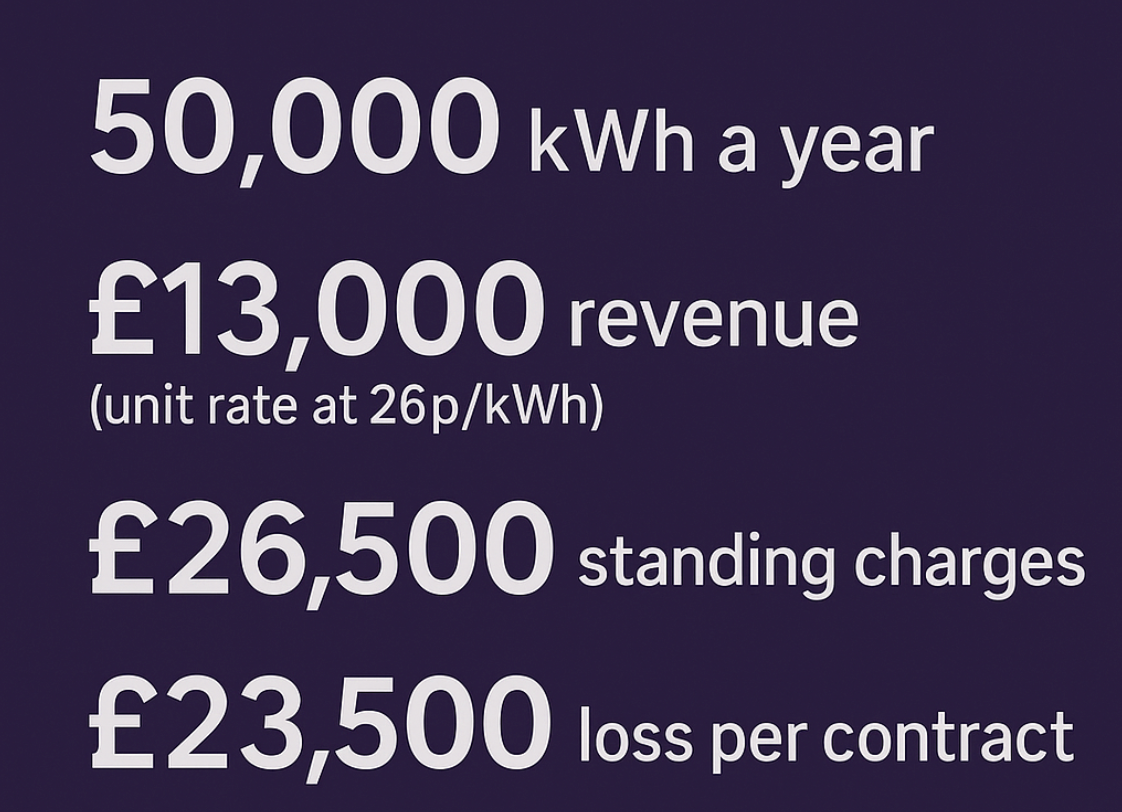

The math was simple and devastating:

A business consuming 50,000 kWh annually at 26p/kWh generated £13,000 in revenue, but standing charge costs alone were £36,500. That's a £23,500 loss on just one contract. Multiply this across hundreds of contracts, and you see exactly how Tomato accumulated £3 million in debt.

The Downward Spiral

By late 2024, industry stakeholders reported unpaid liabilities exceeding £3 million. In April 2025, Ofgem banned them from taking new customers after multiple companies threatened legal action. Despite provisional orders and warnings throughout the summer, Tomato couldn't fix their broken business model. On November 5th, they collapsed.

CEO Farouk Alhassan's admission was telling: despite strong execution on products and marketing, the company "didn't have the capital to support operations in this market." They were taking on loss-making contracts as a "temporary solution" while building technology to fix their pricing - but they ran out of money before the solution arrived.

Red Flags Every Business Should Watch For

Tomato's collapse teaches us what warning signs to watch for in any energy supplier:

Pricing that seems too good to be true usually is. Zero or extremely low standing charges on low-consumption sites should raise immediate questions. If a deal looks unrealistically cheap compared to established suppliers, there's a reason.

Regulatory issues are serious red flags. Watch for Ofgem investigations, bans on taking new customers, or provisional orders. When a regulator steps in, something is seriously wrong.

Operational problems often signal deeper troubles. Delayed billing, poor customer service, or difficulty switching away can indicate cash flow problems.

How to Protect Your Business

Don't chase the cheapest rate. When suppliers collapse mid-contract, you lose preferential rates, face billing complications, and waste time on account transfers. The pounds saved per month can turn into thousands lost.

Prioritise financial stability. Look at trading history, parent company support, customer base size, and regulatory standing. Longevity and proven business models matter more than aggressive pricing.

Work with knowledgeable brokers. At Purely Energy, we actively monitor supplier financial health and regulatory standing. We screen suppliers for financial resilience before recommending them, alert clients when warning signs appear, and only work with suppliers meeting robust financial standards.

Review contracts carefully. Be cautious of zero standing charge contracts unless you have very high consumption. Watch out for recently formed or rebranded suppliers - as Tomato's history shows, name changes can hide troubled pasts.

What If Your Supplier Fails?

If your supplier collapses, your energy supply continues without interruption. Ofgem appoints a Supplier of Last Resort within days, and credit balances are protected. Take meter readings immediately, keep copies of bills, and don't switch until the transfer completes. Once transferred, you're free to switch to a better deal without exit fees.

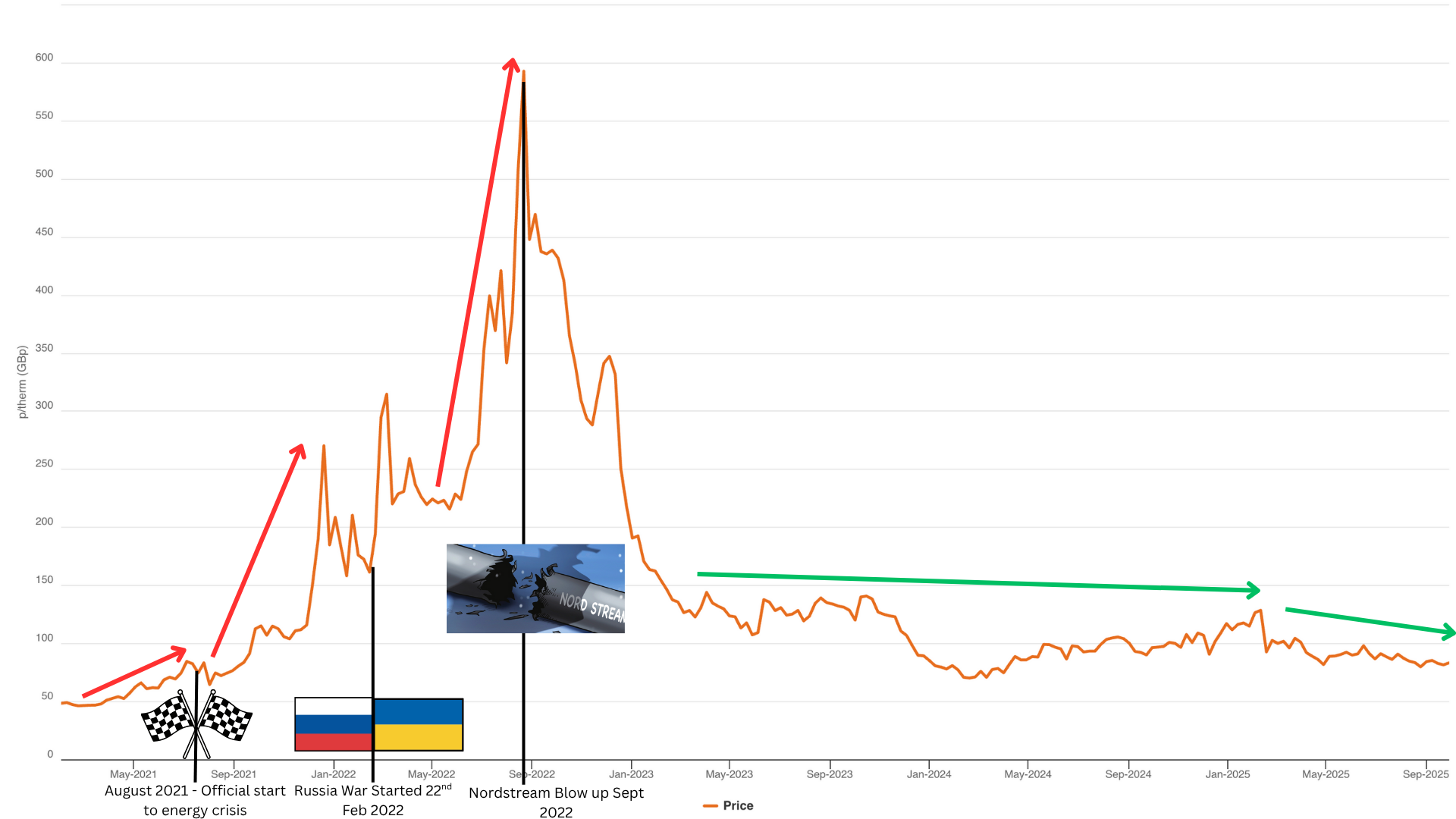

The Market is Changing

Tomato's collapse is the 31st supplier failure since 2021. Here is a list of other collapsed suppliers. Following the 2021-2022 energy crisis, Ofgem introduced stricter financial requirements. The market is consolidating around financially stable suppliers with proven business models. While choice is reducing, stability is improving, and that's actually good news.

How Purely Energy Protects You

We monitor Ofgem enforcement actions, supplier financial reporting, and industry payment behaviour constantly. We only partner with suppliers demonstrating strong financial backing, clean regulatory records, and fair customer treatment practices.

We provide honest assessments of supplier stability, even when it means recommending a slightly more expensive but more stable option. We'll advise against suppliers with financial issues, even if it costs us a commission.

We believe in telling you the truth - your stability matters more than our short-term gain.

The energy market is complex and risky, with suppliers failing even when they seem successful. That's why it pays to work with professionals who prioritise your stability.